The Scandal of Minority Contracting

Race-based contracting regimes threaten core American values, writes Judge Glock

Dear Readers,

Along with liberty and property rights, merit is a core foundation of the success of western civilization, and of the United States in particular. Merit is a form of equality under the law, and without it, everything starts to break.

There are plenty of excuses to do an end-run around merit in this country: “making up for past racism” or other fake framings that ironically echo the logic of “separate but equal.” The abandonment of merit has eroded the competence of our government agencies, universities, and other institutions, while costing our country tens of billions of dollars in grift and waste. Racism is always wrong, and incompetence is intolerable.

There is now a serious effort to unwind the Diversity, Equity, and Inclusion (DEI) complex that has embedded itself across all levels of government. That is encouraging. Yet one of the most pervasive and consequential DEI programs has received little attention: preferences to minority-owned businesses in government contracts.

Judge Glock and I have been discussing how to confront the racism and dysfunction of minority contracting programs specifically, and DEI programs generally, for years. Through the Cicero Institute and other work with Judge, we've sought to restore merit as a core principle in government.

It's not just far-left blue states that are guilty of throwing away merit for diversity; in Texas, the HUB minority contracting program still requires a massive amount of state contracts, up to a third in some sectors, to go through minority-owned companies. In many cases, these programs are tied to a non-white person answering a phone and directing the business, while keeping some percentage as a middleman; in others, scams involve getting a minority as a front-man owner to win the contract despite charging more or doing a worse job.

Worse results are bad for citizens, and unpopular, but diversity programs offer those in government an opportunity to pass money to friends and special interests. Thus, they persist.

It’s disappointing that these "minority contracting" racist policies and scams could thrive anywhere in the USA, but it’s especially annoying that they exist under conservative governments that claim to support merit and oppose DEI. I'm looking at you, Texas. The ball is in the legislatures' court: no doubt huge amounts of lobbyist dollars have found their way to various political leaders to keep the scams going.

Programs that award money and contracts based on race are unconstitutional, anti-American, and corrupt. I hope Judge's piece will encourage more people in government to take another look and end this nonsense — whether at the DoD, in our states, or anywhere else in the USA.

Joe

The Scandal of Minority Contracting

By Judge Glock

Margarita Howard is the founder of the Florida technical services company HX5. The company has benefited from a federal program, known as 8(a), that gives federal contracts to companies owned by “socially and economically disadvantaged” individuals, which typically means racial minorities with insufficient wealth. Thanks to the 8(a) program, HX5 secured hundreds of millions of dollars of federal contracts with agencies from NASA to the Army Corp of Engineers.

While claiming to be “disadvantaged,” Howard lived in a 14,000 square foot waterfront mansion that had been featured on HGTV’s Extreme Homes. Howard and her spouse also had another house, four condos, and a boat worth hundreds of thousands of dollars. Like many participants in the government’s racial contracting program, it turned out that Howard was lying to secure government contracts. In 2023 she had to pay millions of dollars back to the government.

The former Florida home of Margarita Howard, who the federal government considered “economically and socially disadvantaged.”

Across federal, state, and local governments there is a vast web of programs designed to give minority- and women-owned businesses a leg up in contracting deals. Yet these program impose massive costs, are riddled with fraud, and do nothing to help the truly disadvantaged. If one is concerned about waste, fraud, and abuse in the government, there are few easier targets than minority contracting.

Government purchases of goods and services, or procurement, encompass almost everything America government does, from paving roads to building aircraft carriers. The federal government purchases $750 billion in goods and services a year. State and local governments together purchase more than $1.3 trillion. Government purchases constitute almost 10% of our whole economy.

Any program affecting even a small part of these purchases would have a major impact, but the scale of benefits provided to minority- and women-owned business enterprises, or MWBEs, as they’re known, is massive. The Biden administration had a goal that 15% of all federal contracts go to minority or disadvantaged businesses, and by the end of his administration he had hit over 12%, amounting to tens of billions of dollars a year. Many state and local governments, such as New York City, promise that about a third of all contracts go to MWBEs.

In order to meet MWBE contracting goals, favored companies can get contracts without competition with other businesses or can charge substantially higher prices and still win awards. Sometimes, as in Texas’s Historically Underutilized Business (HUB) Program, up to a quarter of a contract has to be subcontracted out to MWBEs or other supposedly disadvantaged firms at extra cost to the contractor and the government.

While other types of Diversity, Equity, and Inclusion (DEI) programs get most of the attention, minority contracting is by far the largest, most costly, and least justifiable form of DEI. Some estimates are that these programs could add anywhere from around 5% to 25% extra to the costs of government projects. Even more importantly, privileging race and sex instead of merit corrupts some of the fundamental operations of government and leads to pervasive fraud and backroom dealing.

Given the scale of minority-contracting programs, it’s not surprising that fraud is common. Late last year, the U.S. Supreme Court debated a case that represents the most common type of minority contracting fraud: pass-through fraud. The government had required two companies, Alpha Painting and Construction and Liberty Maintenance, which were working on a Philadelphia bridge and the 30th Street train station, to subcontract some of their work to disadvantaged businesses. Alpha and Liberty promised to buy millions of dollars of paint from such a firm, but that firm just took a 2.25% fee and forwarded fake invoices back to them. Alpha and Liberty negotiated prices for paint on their own and just forged the disadvantaged firm’s name.

Almost anyone working in the field of government contracting has similar stories about pass-through entities and pointless markups. Wesley Burnett was a government contractor who met Yogesh Patel, the owner of the 8(a) company United Native Technologies, at a business conference. The two agreed that Patel would bid on government contracts, but, since he didn’t have the capability to complete them, he would just pass the work on to Burnett. In exchange Patel would get 4.5 percent of the value for doing nothing.

If a real MWBE company cannot serve as a pass-through entity, recruiting figurehead owners and managers of fake companies will often serve as well. Just a month before the Supreme Court oral argument, the U.S. government got a $52 million settlement from Paragon, a company contracting with the Department of Homeland Security to supply security at federal buildings. Paragon’s executives were using female relatives and friends to serve as figurehead owners to get mandated woman-owned small business contracts, which were then subcontracted back to Paragon.

Since minority contract programs are often awarded outside of typical bidding processes, they are an easy way for politicians to reward political allies. In Atlanta, Larry Scott, the head of the city’s Office of Contract Compliance, which monitors the city’s minority contracting program, started his own business to help companies get those same contracts, which earned him hundreds of thousands of dollars of unreported extra income. It helped that he allied with the mayor’s brother and sister-in-law in the scheme.

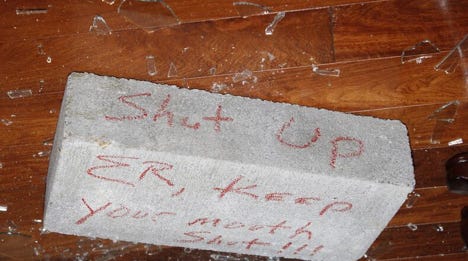

Construction contractor E.R. Mitchell also got special minority deals from the Atlanta city government, despite submitting higher bids, because he was friends with, and started bribing, the mayor’s ally and city official, Mitzi Bickers. When word got out that Mitchell was talking to federal investigators, someone threw a brick through his window with the message “Shut Up” written on it and left dead rats on his front step. As one Atlanta lawyer said of the city’s minority-contracting programs, “This is where friends and family make their money to provide the money for the election campaigns to keep political power.”

Crime scene photo from the house of E.R. Mitchell, a contractor who bribed City of Atlanta officials to get minority-favored contracts and was later threatened to keep quiet.

It’s hard to know exactly how pervasive such contracting fraud is, but we know it’s common. Numerous law firms have programs that focus on disadvantaged business fraud, either attacking it or defending against accusations of it. In 2010 the Government Accountability Office examined just fourteen 8(a) cases and found $325 million in contracts given to firms that were ineligible. A Small Business Administration Inspector General report found that 20 of 25 8(a) firms that they reviewed, which included 10 of the largest 8(a) contractors, should have been removed from the program. Those 20 ineligible firms received $127 million in contracts in just one year. The Department of Transportation Inspector General said in 2016 that over a third of its procurement fraud cases involved disadvantaged businesses.

Despite the pervasive fraud, what is almost as shocking in minority contracting is what is legal. In the 1990s, Paralee White was a lawyer who counseled firms on how to get into the disadvantaged contracting market, but she realized she could benefit more directly. Although she was not an Alaska native, she started a firm that worked with Alaska natives to get federal contracts. She hired her sister and brother, and got her sister’s boyfriend to start his own firm with Alaksa natives, where he made more than $500,000 a year. In the aftermath of the September 11th attacks, White and her associates got more than $500 million in Pentagon contracts, even though less than 1% of those went directly to Alaska native corporations, as a Washington Post analysis later showed. As long as 51% of the joint firms were owned by Alaska natives, though, and even if these firms passed basically all of the contracts to large non-native firms, it was all above board.

The goal of the federal 8(a) program is to help the supposedly disadvantaged, so applicants must prove they are “economically disadvantaged” as well as a discriminated-against minority. But no one outside the government would consider most of the applicants for this program to be disadvantaged. After the Biden administration increased the asset threshold in 2022, the federal government now requires an individual to have less than $850,000 in net worth to remain eligible. That alone would put someone comfortably in the top 20% of households for wealth. Yet the calculation excludes the individual’s home or retirement accounts, the two areas that constitute the vast majority of typical Americans’ wealth. Anyone with almost a million in free cash sitting around is not hard up. The federal regulations also allow a maximum income over $400,000 a year. This would put an applicant in the top 2% of all households. And these calculations do not even include spouses’ assets or income. Given these high asset and income cut-offs, it’s surprising that some owners, such as Margarita Howard, have to lie about their balance sheet to meet the threshold, and yet they do.

Many of the “disadvantaged” business owners under these programs come from very privileged backgrounds. Jay Bajaj started the technology company DMI in 2002 and quickly secured 8(a) status. He has described his business as beginning with just a desk and a chair from Price Club and a lot of cold calls for government contracts. Perhaps it helped, though, that his dad, Ken Bajaj, had started a technology company, AppNet, that sold for $2.1 billion, and his mom started another company that sold for $200 million. Yet Bajaj was treated as disadvantaged enough to need a leg up on other companies. The Bajajs are also part of a group, Indian-Americans, that, although counted as disadvantaged by the federal government for contracting purposes, has an average household income almost double the American average.

Earl Stafford Jr. claimed that when he was younger discrimination against black Americans made him feel he did not have what it took to succeed. Thus he thinks 8(a) program provided him and his company, Aperio Global, a necessary chance. Yet his father Earl Stafford Sr., founded a successful defense training company that was sold Lockheed Martin. Stafford Sr. could afford to pay over a million dollars just for a special President Barak Obama inauguration celebration.

The government is currently wasting tens of billions, perhaps hundreds of billions, of dollars a year on programs that degrade everything from our infrastructure to our national defense, do nothing to help the disadvantaged, and are riddled with fraud. Ending minority contracting programs would go a long way to restoring meritocracy and reducing corruption in government.

Judge Glock is the director of research at the Manhattan Institute.

Thank God for you, Joe. I pray for you every night. You're addressing things that no one else will touch. You give me hope.

This has been going on for almost half a century. Google Kathy's Kranes. The woman "running" that business was having sex with a Small Business Administration officer to win 8a contracts from the federal government. The company was run by white guys and passed-thru entire contracts to real contracting businesses who did the actual work-- also run by white guys. A bunch of them went to jail, but I'm surprised that a program so prone to scams like this is still in existence after so many years of obvious corruption.