Capture the Flag

Cronyism, capitalism, populism, and more.

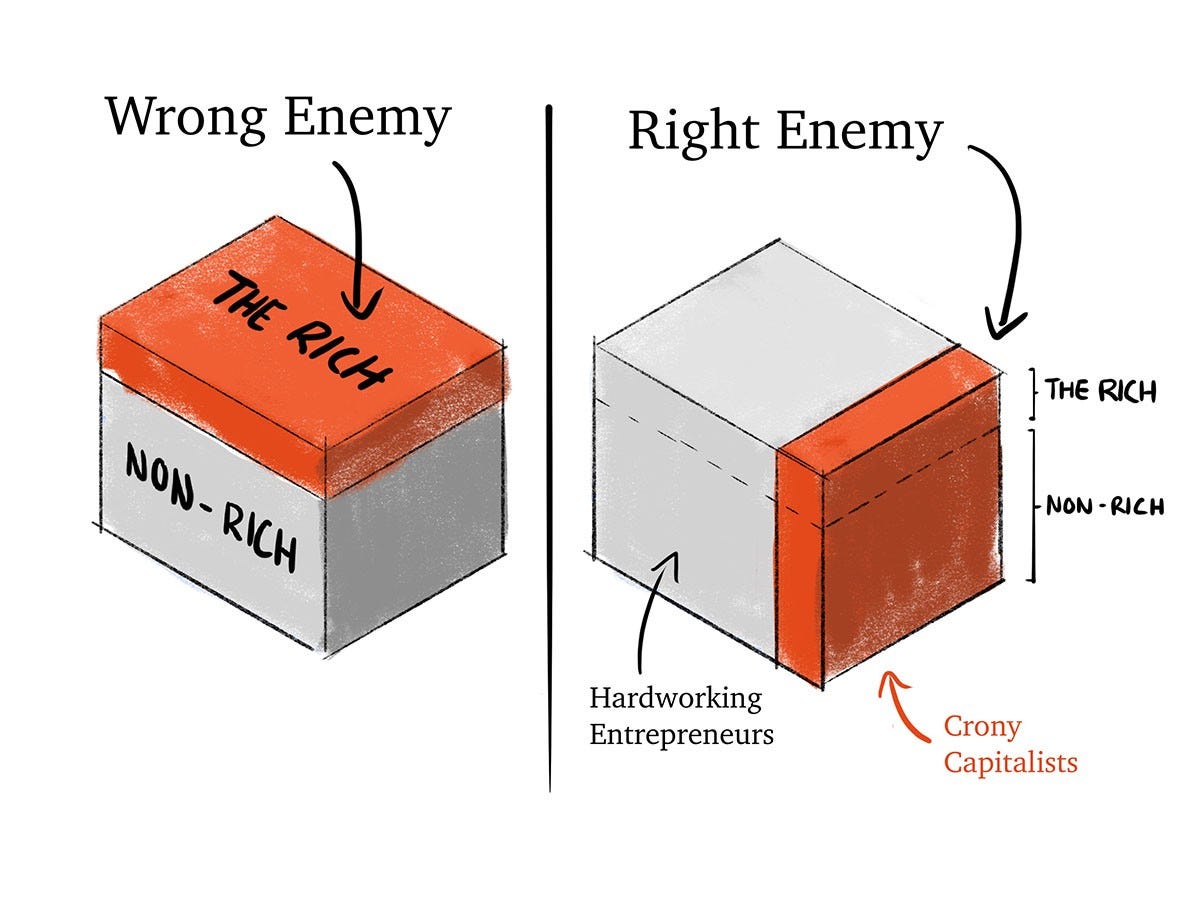

American capitalism is under siege. Nationalist-Right politicians defend reincarnations of 20th century industrial policy and blame weak wage growth on immigrants and foreign exporters. Meanwhile far-Left politicians including Bernie Sanders and Elizabeth Warren have popularized traditional Marxist critiques of the rich and want the federal government to nationalize banks, the healthcare system, and other sectors of the economy. Each rejects market competition in favor of expanded state involvement in the American economy. Each side has it wrong.

The problem with capitalism today is that market competition itself is in decline. The gravest threat to the American economy is “crony capitalism”, whereby special interests including industry groups and unions pervert the policy making process in order to restrict competition and line their own pockets. Market competition is precisely the feature of our economy that we must fight to preserve.

A competitive market is an evolutionary system in which every business must constantly test its worth against entrepreneurs with bold, new ideas. As Joseph Schumpeter noticed long ago, entrepreneurs create value for society by destroying outmoded, inefficient modes of business and replacing them with more productive models. Market competition naturally rewards creativity, innovation, and entrepreneurial genius, no matter how unexpected their origins. It ensures that the best ideas go viral, the worst ideas vanish into obscurity, and business leaders pay for their mistakes with lost market share.

When the best ideas win, we all benefit. In the past two centuries, entrepreneurs have developed fantastic innovations and streamlined modes of production, lifting our population from agrarian poverty to standards of living that would have astounded our ancestors. It’s no overstatement to say that the profit-motive — the right to keep one’s earned income — is the main explanation for this tectonic shift in human life. But if the profit-motive is the principal reagent in the grand experiment of economic progress, it is also dangerously volatile and corrosive.

In a state of nature, our acquisitive drives bend towards violent appropriation of the wealth of others. A legal framework that enshrines individual rights to person and property is the essential bulwark against this kind of brute force. But an expansive modern government presents private corporations with thousands of new opportunities to twist the coercive power of the state to favor their private interests. In medieval times cronyism was straightforward: the crown granted monopoly charters to favored guilds and corporations in exchange for bribes. Today’s crony capitalism replicates this old system of client politics in subtle, insidious ways.

Defense

The military-industrial complex is the granddaddy of all crony industries. The scholar Gordon Adams identified an “iron triangle” of special interest linking Congress, the military, and private contractors, such as Lockheed, Raytheon, and Northrup Grumman.[2] The unholy union of pork-barrel politics, revolving door dynamics, and the plausible alibi of national security imperatives is the perfect cover for corruption and waste in the defense sector. One half of the Department of Defense budget is allocated to contractors every year and impartial decision making in military contracting alone could save our country at least $100 billion annually. [3] But the true magnitude of waste in the American defense industry is much higher.

Traditional economic laws just don’t seem to apply to the fantasyland of defense contracting. Unit economics are often mind boggling. Journalists were outraged to discover that during the Reagan administration our military spent $600 per aircraft toilet seat cover and $7,662 on a certain coffee machine.[4] But today the toilet seat covers cost $10,000 apiece, and we’re spending $1,280 per mug on reheatable coffee cups![5]

A defense contractor such as Lockheed Martin will typically secure congressional “buy-in” to a contract at a low rate, and then ratchet up the price of the contract on the premise of sunk cost. Cost overruns on complex goods such as planes range as high as 3–4x the original estimates. Congress has financially bailed out private contractors, financed mergers between private contractors, issued no-bid deals to private contractors, and lent private contractors money for arms deals at egregiously low rates.[6]

In return, defense contractors have metastasized and begun selling ludicrously overpriced, low-quality products to every government agency they can sink their fangs into. Consider that Lockheed Martin is the largest contractor not only for the Pentagon, but also for the Department of Energy and the Department of Transportation, the second largest contractor for the Department of State, and the third largest contractor for NASA.[7] We spend over $300B a year in defense contracts with private contractors alone, but when you include non-defense expenditures the number is far higher.[8]

Defense contractors typically locate production in as many congressional districts as possible so that Congress members will be able to claim they’ve “brought home jobs” to their districts when they award insane military contracts. Military executives are so completely aligned with private contractors that they often split up lobbying efforts for contracts. As Senator William Proxmire put it in 1969 “How hard a bargain will officers involved in procurement planning or specifications drive when they are one or two years from retirement and have the example to look at of over 2,000 fellow officers doing well on the outside after retirement?”[9]

Banks

If the defense contractor industry’s death grip on government is a “military-industrial complex”, American banking may justly be described as a “Wall Street-treasury complex.” Revolving door hiring is rampant. During the writing of Dodd-Frank, 47 of 50 Goldman Sachs lobbyists, 42 of 46 JPMorgan Chase lobbyists, and 35 of 46 Citigroup lobbyists had held government positions.[10] And the Treasury Department — led by former Goldman Sachs CEO Hank Paulson — was packed to the gills with former investment bankers.[11]

It is an inescapable reality that the individuals with the expertise to regulate an industry are the same individuals who achieved positions of prominence within that industry, and finance is no exception. But it would be naïve to assume that former bankers launch new careers as financial regulators tabula rasa, with pure motives.

After the mortgage crisis and the savings and loan bailouts of the 1980s, which cost taxpayers over $200 billion, the government expanded Fannie Mae and Freddie Mac — two of the most offensive examples of crony capitalism in the country. Although technically private, the two mortgage lending giants had special access to U.S. Treasury loans, federal officials on their boards of directors, and an implicit guarantee from the government. Beginning in 1992, administrations from both political parties also expanded the low-income lending goals of these two giants, until over 50% of their loans went to low-income families. These questionable loans contributed to the giants’ collapse and bailout in 2008, which cost taxpayers over $180 billion.

Other banks also benefit from implicit government guarantees. Since the bailout of the Continental Illinois bank in 1984, large banks have assumed that the government will rescue them in a crisis. The too big to fail problem creates a “moral hazard”: banks take riskier bets with the understanding that the government will bail them out if those bets sour.[12] As expected, the federal government’s Toxic Asset Relief Program (TARP) provided over $450 billion of bailout capital to banks during the 2008 crisis, at terms grossly favorable to the banks.[13] To manage the vast portfolio of troubled assets the Federal Reserve acquired after the bailout, Treasury Secretary Tim Geithner gave three no-bid contracts to BlackRock, which spends tens of millions a year hiring former government employees and lobbying the federal government.

The Dodd-Frank Act reinforced the crony relationship between our government and financial industry. Today, a bank in trouble does not go through an ordinary bankruptcy. Instead, the “Orderly Liquidation Authority” gives special debtor financing and creditor support to a failing bank. In addition, Dodd-Frank and subsequent regulations made it harder for small and new banks to compete with large incumbents. Since Dodd-Frank, over 2,000 small banks have closed their doors. And while hundreds of new banks once opened every year, since 2009 the federal government has only approved about a dozen new banking applications.[14]

A combination of anti-competitive regulation, and special government subsidies coddles America’s big banks more than virtually any businesses in the country. American taxpayers lost $200 billion in the Savings and Loan bailout, and our government is now on the hook for hundreds of billions more. America’s financial system is one of the biggest beneficiaries of crony capitalism today.

Healthcare

As we have discussed elsewhere, the American healthcare system spends twice the OECD average per patient, and wastes up to $1 trillion annually. American government is implicated in a web of financial relationships with thousands of private corporations in the healthcare industry, each of which is subject to perversion. But even more disturbing is the ease with which incumbent corporations lobby to manipulate healthcare laws and regulations in their favor.

A paradigmatic example of special interest capture in American healthcare is the hospital industry, represented by the American Hospital Association (AHA). Hospitals are often the largest employers in their congressional districts, and routinely mobilize local doctors to persuade congress members to enact laws increasing federal funding or kill unfavorable bills in committee hearings.[15] Although hospitals drive 1/3rd of healthcare costs and are the worst special interest in the healthcare industry by far, they have successfully shifted politicians’ attention to the insurance industry.

Next, consider the case of Medicare, which insures elderly or disabled Americans. Medicare Part B sets rates for all services provided by physicians, on which the federal government spends over $300 billion annually. Prices for procedures are specified by the Specialty Society Relative Value Scale Update Committee, or “The RUC.” One could be forgiven for assuming that the RUC is comprised of government bureaucrats. In fact, it’s an offshoot of the American Medical Association — one of the most powerful trade groups in the entire healthcare industry. This cabal wields its influence to favor costly specialty care over primary care, and the prices of physician services skyrocket, year after year.[16],[17]

Another way that doctors inflate their own salaries is by legally barring nurses, chiropractors, naturopathic doctors, and other health professionals from practicing at the full scope of their medical training. Although many states have taken measures to shift “scope of practice” laws, over 76% of non-physician health workers currently face restrictions — at the American consumer’s expense. For example, occupational licensure regulations that require nurse practitioners to be supervised by MDs when prescribing drugs increase physician wages by about 7%, with a corresponding increase in consumer costs.[18]

Finally, consider the pharmaceutical industry. In what most regard as a Faustian bargain, the Obama administration secured the pharmaceutical industry’s support for the ACA by barring Medicare from negotiating the price of pharmaceutical drugs. Consequently, prices for physician-administered drugs grew at a compound annual rate of 10.1%, and prices for prescription drugs grew at a rate of 11.3% from 2013–2017.[19] Drug manufacturers also engage in profiteering by gaming intellectual property law. The intended lifespan of a pharmaceutical patent is 20 years. But for the 12 best selling drugs in the United States, drug makers file hundreds of patent applications, extending their true patent exclusivity to 38 years! Prices have increased by 68% since 2012 for these blockbuster drugs.[20]

As consumers and taxpayers, Americans not only generate enormous piles of lucre for healthcare corporations but effectively subsidize healthcare costs for the rest of the world. Here, as in so many other industries, lobbyists use traditional financial contributions to open doors, and then manipulate politicians and regulators with a typhoon of misinformation and scare tactics. As Congress debated the Affordable Care Act in 2009, there were six registered healthcare lobbyists swarming Capitol Hill for every one member of Congress. Think-tanks and patient advocacy groups make some headway in reforming our healthcare system each year, but crony capitalists in American healthcare have an overwhelming advantage.

Trial Lawyers

Tort litigation is lawsuits about harms that violate civil, not criminal law. The field emerged in the late 19th century and won a series of major victories in the 1960s and 1970s under the banner of Ralph Nader’s consumer protection movement.[21] Today the trial lawyers’ lobby is closer to a cartel aimed at extorting businesses than a consumer advocacy lobby aimed at keeping Americans healthy and safe.

In the past decade, lawyers and law firms have spent $780 million on federal campaigns, and $725 million on state campaigns.[22] The chief trial lawyer industry group is the American Association for Justice, which often funds million-dollar campaigns to defeat tort reforms and instead elect lawyer-friendly state judges to the bench. These judges then hand down verdicts which expand the grounds for new tort lawsuits. In addition, the AAJ lobbies for state legislation to expand definitions of consumer fraud, eliminate statutes of limitation on tort claims, outlaw arbitration clauses in employment contracts so they can force cases to trial, and facilitate “legal fishing” expeditions which allow tort lawyers subpoena documents on the shakiest of grounds.

The result of these crony lobbying efforts is an entire sub-industry of lawyers who bring tort lawsuits with little pretext save to enrich their own practices. The class-action settlement rate is an abysmal 33%, which is lower than tough federal cases, but lawyers persist in suing American companies in the wild hope that they’ll win and take a lucrative cut of the payout.[23] For top personal injury lawyers and other varieties of tort litigators, payouts are lucrative indeed. By some reports a hundred or more trial lawyers are currently flying around the country on their own private jets.

The destructive effect of tort litigation is obvious when one considers the social cost of medical malpractice lawsuits. The annual administrative expenses associated with the medical liability system are $4 billion per year, and malpractice liability payments are $5.7 billion a year. Some of these cases are clearly warranted. But the true cost of medical malpractice suits is that doctors are incentivized to practice defensive medicine and order extraneous and unnecessary services in order to minimize their legal liabilities.

A recent study by Jonathan Gruber, one of the principal architects of the Affordable Care Act, investigated the Military Health System, where doctors are often immune from liability for medical malpractice. Gruber found that the intensity of inpatient care for active-duty patients (who may not sue their doctors) is approximately 5% lower than the intensity of care for non-active duty patients, or soldiers who receive care in private civilian facilities — with no difference in health outcomes.[24] In particular, doctors exempt from liability tended not to prescribe useless, expensive diagnostic tests.

Broadening this result to the general economy suggests that medical malpractice suits alone are easily responsible for tens of billions if not over a hundred billion dollars in pointless damages and legal fees per year. Speculative tort lawsuits in other sectors account for tens of billions more in societal resources squandered on lawsuits rather than productive ventures. Despite the claims of tort reformers, when the country is subject to rule by trial lawyers, it is the American consumer who ultimately loses.

Public Sector Unions

Public sector unions may not qualify as capitalist, but they are certainly crony. Government employee unions have a zombie grip on our political apparatus. Groups such as prison guards, firemen, clerks, and teachers’ unions typically coerce government employees into paying union dues which are then used to elect union-friendly politicians and bully incumbent politicians into passing legislation that favors union interests. It’s political patronage, pure and simple.

The makeup of unionized workers in America is shifting. 2009 marked the first year that public sector union employees outnumbered private sector union employees, 7.9 million to 7.4 million.[25] Between 1960 and 1980, the portion of full-time unionized public employees jumped from 10% to 36% of the public-sector work force. The American Federation of State, County, and Municipal Employees (AFSCME) grew from 99,000 members in 1955 to just under 1 million members and the American Federation of Teachers grew from 40,000 to more than half a million members.

Public sector unions are now wildly powerful players in American politics and have become extraordinarily successful at securing crony benefits for their members. In general, the salaries of public sector union members are anywhere from 17–37% higher than their private sector counterparts, and government employees make $14 more per hour in total compensation than private sector workers.[26] Between 2000 and 2008, the price of state and local public services has increased by 41% nationally, compared with 27% for private services. But the larger problem is that government employees retire at early ages to receive taxpayer-funded pensions for the rest of their lives.

Consider the example of the California Correctional Peace Officers Association (CCPOA). The CCPOA has extensively lobbied the state government to build new prison facilities, increase the number of prison guards in the state’s employ, and give prison guards and parole agents cushy salaries, benefits, and pension plans. Between 1980 and 2000, California constructed 22 new prisons for adults, and by 2006 the average prison guard made over $100,000 annually with overtime. Corrections officers can retire at 50 and take 90% of their salaries for the rest of their lives. Today a full 11% of the state budget — more than the state spends on higher education — goes to the California penal system.[27]

Public employee pensions are frighteningly underfunded. Unlike a traditional 401k, public employee pensions pay defined benefits to pensioners, regardless of how the market is performing. And public employee pensions typically use over-optimistic projected returns and discount rates, promise an unreasonably high level of benefits to pensioners, and then have to revise the expected rate of return downwards, increasing total liabilities drastically. For instance, the two largest public employee pensions in California — CalPERS and CalSTRS — initially projected returns of 7.5% but gradually revised that number to 7%, with the result that expected liabilities miraculously doubled.[28][29] Actual returns are even lower.

Pension liabilities are stripping revenue away from our basic government programs, even after a decade of stock market growth. For example, Oakland schools recently cut their budget by $15 million after a 30% state tax increase.[30] Pension costs have forced cities into insolvency in many states, and in a completely unprecedented development the entire state of Illinois may now go bankrupt, despite high tax rates.[31],[32] Estimates of total unfunded liabilities for state and local pensions range around $5 trillion.[33][34] Unless we take immediate steps to rectify this problem, government employees are in for major benefit cuts over the next decade.

NIMBYS

A final example of crony capitalism is the capture of local government by owners of urban real estate. Nowhere is the division between insiders and outsiders clearer or more literal than in housing. In many of America’s most dynamic cities, wealthy insiders have labored to prevent outsiders from moving into those cities. “NIMBY” (“Not in My Back Yard”) homeowners aim to create a false scarcity of land in order to retain the historic character of their neighborhoods and protect their home values against competition from new developments.

Although only 3% of America is urbanized, NIMBYs have used zoning and permitting requirements to make hundreds of millions of acres around cities effectively off-limits to new building. Some of these insiders have seen their properties appreciate by four or five times their original values, while outsiders must pay between four or five times the amount of rent or suffer torturous commutes to access opportunities in American cities.

It wasn’t always this way. For most of American history, a new home cost about three times the average family’s income. As incomes climbed, families bought bigger and better homes, but the proportion of their income going to housing stayed the same. Beginning in the 2000s, housing suddenly spiked to five times a family’s income. Many commentators described this phenomenon as a housing price bubble attributable to Americans gorging on cheap loans. Now we know the truth.[35]

Most of American cities never saw a housing price “bubble,” because they never restricted new development. Today, just as before 2008, housing around Austin, Texas, or Columbus, Ohio, still costs about three times average income. Yet in a handful of cities, such as San Francisco, New York, or Boston, homes cost from five to nine times a families’ income![36] These cities’ prices have already surpassed their peak during the “bubble,” and will continue rising as long as these cities keep restricting new development.[37]

While long-time residents of these cities have made millions off their appreciated housing, the rest of America remains locked out of these dynamic regions. One recent paper estimated that just removing housing restrictions in the Bay Area and New York would increase the average American family’s annual income by $2,000, due to increased competition for high-quality jobs.[38] NIMBYs don’t just hurt local renters and would-be homeowners, they cripple the entire economy.

Conclusion

Too frequently our elected leaders describe American politics as a grand struggle between the forces of good and evil. This kind of mythological rhetoric obscures the true nature of the complex systems at work in our economy. The central problem facing our economy is the way in which private corporations and individuals interact with the different faces of our government.

The problem is not that conservatives or progressives are evil but rather that our economic system and mode of government gravitate towards an equilibrium in which special interests have captured our political institutions. As the case of NIMBYism so clearly illustrates, the problem isn’t them, it’s you. We are too quick to demonize our fellow Americans and impatiently demand titanic policy reforms. Instead we need to make a conscious effort to identify when we or our employers are milking the political process at the expense of others.

We must work hard to ensure that every level of American government impartially serves the general public and resist the impulse to profit from illegitimate special relationships as a matter of conscience. Both Republicans and Democrats need to find the courage to stand up to special interests, especially the special interests on their own side. A breed of leaders who fight corruption even when it is politically inconvenient to do so could make our country grow and prosper at rates that we haven’t seen in many decades.

There are more instances of cronyism in the American economy than any essay could indict. The threat today is that our government is silently lapsing by degree into a feudal order in which special interest cartels dictate the economic life of our people. To achieve another century of economic progress and preserve the integrity of our republic, we must combat crony capitalism in every branch and jurisdiction of American government.

[1] Smith, Adam. “The Wealth of Nations.” Chapter 3, Part 2. https://www.marxists.org/reference/archive/smith-adam/works/wealth-of-nations/book04/ch03b.htm

[2] https://en.wikipedia.org/wiki/Iron_triangle_(US_politics)

[3] In 2017, for example, the total DoD budget was $605.7 billion of which $320 billion went to private contractors. See: Schwartz et al. “Defense Acquisitions: How and Where DOD Spends Its Contracting Dollars.” Congressional Research Service, July 2, 2018.

[4] Hartung, William. “Prophets of War.” Nation Books, 2012. p.136

[5] Taibbi, Matt. “The Pentagon’s Bottomless Money Pit.” Rolling Stone, March 17, 2019.

[6] Hartung, William. “Prophets of War.” Nation Books, 2012. p.114, 170, 196

[7] Hartung, William. “Prophets of War.” Nation Books, 2012. p.29.

[8] Hartung, William. “Here’s Where Your Tax Dollars for Defense are Really Going.” The Nation, October, 2017.

[9] https://www.govinfo.gov/content/pkg/CRECB-2011-pt15/html/CRECB-2011-pt15-Pg20187-2.htm

[10] Salter, Malcolm. “Crony Capitalism, American Style: What Are We Talking About Here?” Edmond J. Safra Working Papers, №50. October 22, 2014. https://www.hbs.edu/faculty/Publication%20Files/15-025_c6fbbbf7-1519-4c94-8c02-4f971cf8a054.pdf.

[11] Creswell, Julie and Ben White. “The Guys from ‘Government Sachs’.” New York Times, October 17, 2008.

[12] For evidence of the implicit guarantee see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2554386

[13] The Treasury and the Fed bought the investment banks’ most toxic assets for high prices rather than their best assets for low prices, insured the banks at below market rates, and so on.

[14] https://www.economist.com/finance-and-economics/2018/05/31/the-number-of-new-banks-in-america-has-fallen-off-a-cliff

[15] Cooper et al. “Politics, Hospital Behavior, and Health Care Spending.” Cowles Foundation, Yale University. August, 2017.

[16] For example, the RUC set the price of an arterial stent at $12,000, despite the fact that it’s a simple procedure that could be performed in a doctor’s office. The number of stent implants performed nationally increased by 70% in the next few years. See: Glock, Judge. “How Physicians Write Their Own Paycheck: The Relative Update Committee.” The Cicero Institute, April 28, 2019.

[17] Poses, Roy. 2011. “Conflicts of Interests Among the RUC’s Members,” Health Care Renewal.

[18] Kleiner et al. “Relaxing occupational licensing requirements: analyzing wages and prices for a medical service.” NBER, February 2014.

[19] Lieberman, Steven and Paul Ginsburg. “CMS’s International Pricing Model for Part B Drugs: Implementation Issues.” Health Affairs, July 9, 2019.

[20] https://www.i-mak.org/wp-content/uploads/2018/08/I-MAK-Overpatented-Overpriced-Report.pdf

[21] Nader, Ralph. “Suing for Justice.” Harper’s, April, 2016.

[22] “Trial Lawyers Inc.” Center for Legal Policy at the Manhattan Institute. 2010.

[23] https://www.forbes.com/sites/danielfisher/2013/12/11/with-consumer-class-actions-lawyers-are-mostly-paid-to-do-nothing/#7ad51c451472

[24] Frakes, Michael and Jonathan Gruber. “Defensive Medicine: Evidence from Military Immunity.” NBER, July 2018.

[25] DiSalvo, Daniel. “The Trouble with Public Sector Unions,” National Affairs. Fall 2010. https://www.nationalaffairs.com/publications/detail/the-trouble-with-public-sector-unions.

[26] https://oversight.house.gov/sites/democrats.oversight.house.gov/files/documents/Biggs-AEI%20Statement%20Federal%20Compensation%205-18.pdf

[27] Sherk, ibid.

[28] https://www.ppic.org/publication/public-pensions-in-california/

[29] Crane, David. “More Pension Math.” February 15, 2018.

[30] Dougherty, Conor and Jose A. Del Real. “California Today: Is the Long Looming Pension Crisis Already Here?” New York Times, March 9, 2018.

[31] Sherk, James. “Time to Rein in Public Sector Unions.” The American Interest, September 7, 2015.

[32]https://www.realclearpolicy.com/articles/2018/06/07/illinois_is_better_off_bankrupt_110660.html

[33] https://www.wsj.com/articles/the-pension-hole-for-u-s-cities-and-states-is-the-size-of-japans-economy-1532972501

https://us.pensiontracker.org/

[35] https://www.longtermtrends.net/home-price-median-annual-income-ratio/

[36] https://www.citylab.com/equity/2018/05/where-the-house-price-to-income-ratio-is-most-out-of-whack/561404/

[37] https://www.citylab.com/equity/2018/05/where-the-house-price-to-income-ratio-is-most-out-of-whack/561404/

[38] https://faculty.chicagobooth.edu/chang-tai.hsieh/research/growth.pdf