A Silver Tsunami?

Some thoughts on the future of American small business.

Dear Readers,

At 8VC, we spend a lot of time investing in and building leading companies in the innovation world, especially AI, biotech, and national defense. As patriots, we know that these sectors will play a large role in defining – and protecting – American innovation and wealth creation in the coming decades. But there’s another massive shift happening that gets far less attention: the largest transfer of business ownership in American history.

This piece, written with my colleague Denis Aven, outlines a solution to what could become Main Street’s extinction event—and explains why it’s one of the best investment opportunities we’ve seen. Great firms like the one Denis is carving out from 8VC, platforms like Mainshares, and others are working hard to build the necessary infrastructure to address the challenge of small business succession by removing barriers to entry and letting capable young Americans take the reins. This is hard, important work that will preserve the backbone of the American economy and its tradition of ownership.

Many of the Founding Fathers were “SMB entrepreneurs” themselves. Benjamin Franklin ran a printing press, Sam Adams owned a piece of a malthouse that brewed beer, John Hancock managed an import-export firm, and countless others traded across their communities. Personal ownership has always fueled innovation and fostered accountability – not just for individuals, but for the areas they serve.

If we succeed, millions of Americans will continue to own and operate viable small and medium-sized businesses, local communities will keep thriving, and a new generation will have a real shot at the American Dream. Fewer people should be focused on finding better jobs, and more should be thinking about becoming owners—ready to operate, grow, and scale. To make that possible, they’ll need partners willing to invest in and support them as trillions of dollars’ worth of businesses change hands. For hard workers prepared to lead, build, and take risks, the rewards of entrepreneurship have never been greater.

Joe

The ~$10 Trillion Silver Tsunami: Who Will Run America’s Small Businesses?

By Joe Lonsdale and Denis Aven

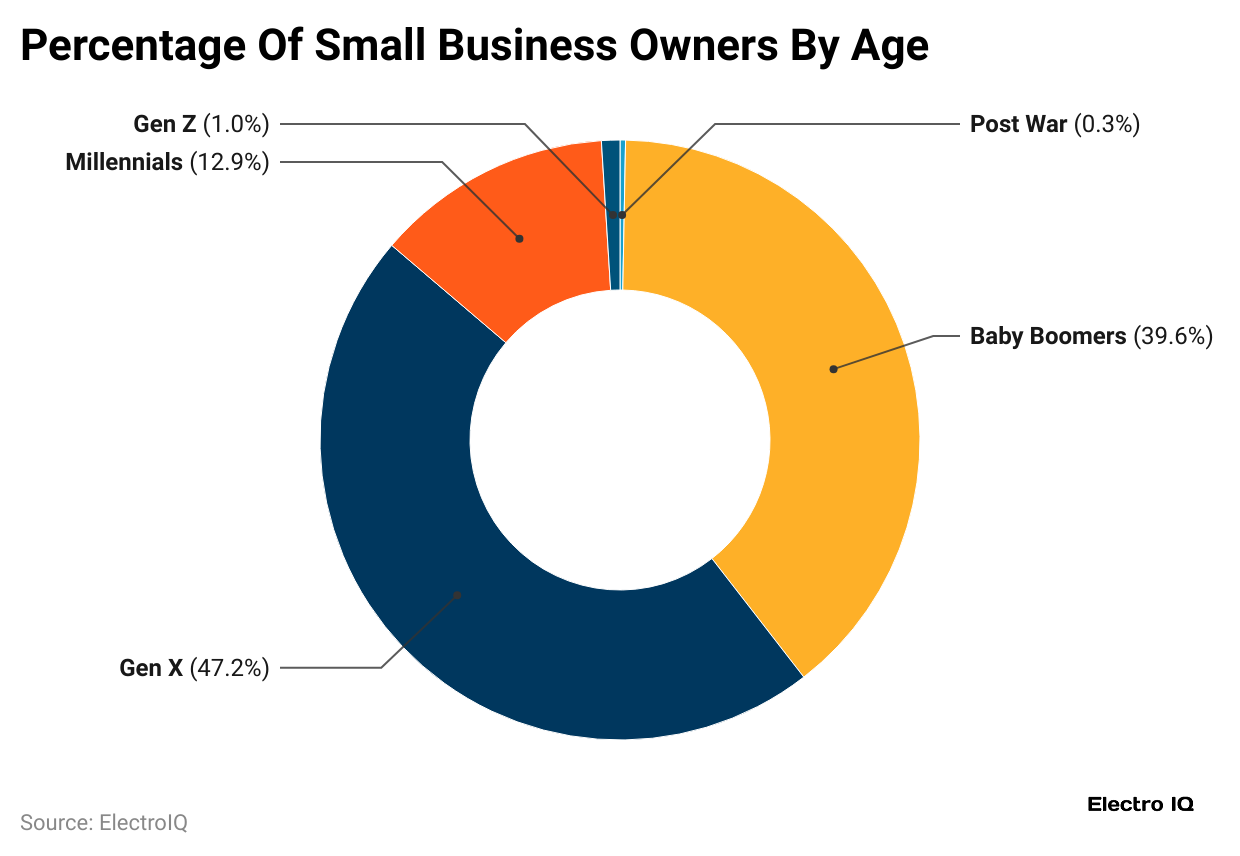

Every day, 10,000 baby boomers reach retirement age. Many own the hardware stores, auto shops, and accounting firms that form the backbone of local economies. But unlike previous generations, their children usually aren’t interested in taking over.

The result is a looming crisis for Main Street. Over the next two decades, 3 million small business owners over the age of 55 will look to exit their companies in what is often called “The Silver Tsunami.” This is a $10 trillion wave in business value that will have to change hands. Nearly half have no succession plan, and for those that plan to sell, surveys show that only 30% to 40% listed for sale are ever sold.

Without a scalable strategy to transition to new owners and operators, Main Street faces a mass extinction event since many of these businesses won’t be sold and will be forced to close their doors. When these businesses disappear, we lose the sponsor for the local Little League team, the familiar face behind the counter, and good-paying jobs that keep Americans afloat through economic cycles.

The traditional path of passing the family business to the next generation is breaking down. Children pursue different careers, families scatter across the country, and younger relatives usually lack the cultural work ethic and interest to manage the business.

Although familial succession is less popular, an increasing number of Americans are interested in running these kinds of companies. Funds created to buy and operate SMBs are reaching record levels. But outside elite Wall Street circles, capable operators face massive barriers: insufficient capital for down payments, no experience navigating complex transactions, and limited support systems for the steep learning curve of ownership.

Why Private Equity Isn’t the Only Answer

I have previously written about how private equity plays a key role in growing our economy and making companies more productive by eliminating redundant processes, improving management, and restructuring poorly run businesses.

However, the traditional PE playbook doesn’t always work for small businesses. Small acquisitions require the same due diligence as large ones but generate far less profit. Hiring professional managers on a salary costs too much at such a small scale. And underwriting is harder—most small businesses have messy financials and limited data. Because PE managers are compensated based on capital deployed, they naturally pursue larger deals.

Some funds have adopted a “roll-up” strategy — systematically acquiring smaller companies to build a larger platform business. However, many private equity firms operate within 5-year investment horizons, which pushes them to focus on short-term value drivers like raising prices, increasing leverage, and cutting costs. While that approach sometimes works, many businesses can create more value by taking a longer view—embedding themselves deeply in their communities, cultivating local trust, and pursuing sustainable growth over a decade rather than a few years.

Developing specialized long-term strategies that create jobs for a specific company generating $1 million in annual earnings might not interest a buyout fund (with an average fund size of around $843 million), but it could be life-changing for an individual operator in it for the long haul, potentially adding hundreds of thousands to their personal income.

Entrepreneurship through Acquisition (ETA) and search funds offer such a model: an entrepreneur raises capital to find, buy, and run a single business as CEO. With longer time horizons and hands-on leadership, this approach preserves local ownership while addressing the succession crisis facing many small businesses.

But ETA hasn’t scaled to meet demand. Rigid criteria, heavy investor oversight, and bias toward Ivy League and banking backgrounds limit access for operators who have built relevant skills through years of industry experience.

The central challenge is pairing seasoned operator talent with capital and resources in a market that is opaque and overwhelmingly non-institutional. Thousands of small business brokers compete for a fragmented supply of mom-and-pop listings, while most supply aggregator sites still resemble dot-com era classifieds. Top operators are scarce, and systematically identifying the right talent remains difficult. Data is fragmented and poorly standardized, while the broader infrastructure for small business transactions is still in its infancy.

An auto shop manager with 15 years of experience might have only $50,000 in savings while supporting a family—nowhere near the $300,000 needed to acquire a $2 million business he’s qualified to lead. He also lacks expertise in business valuation, due diligence, and navigating Small Business Administration (SBA) loan requirements. Even if he clears those hurdles, surveys find that the administrative burden of ownership—payroll, bookkeeping, tax compliance—remains one of the biggest barriers to success.

While accelerators like Y Combinator have democratized access to startups by offering structure and support, the small business and ETA ecosystem lacks a platform to make small business ownership accessible at scale.

A New Opportunity

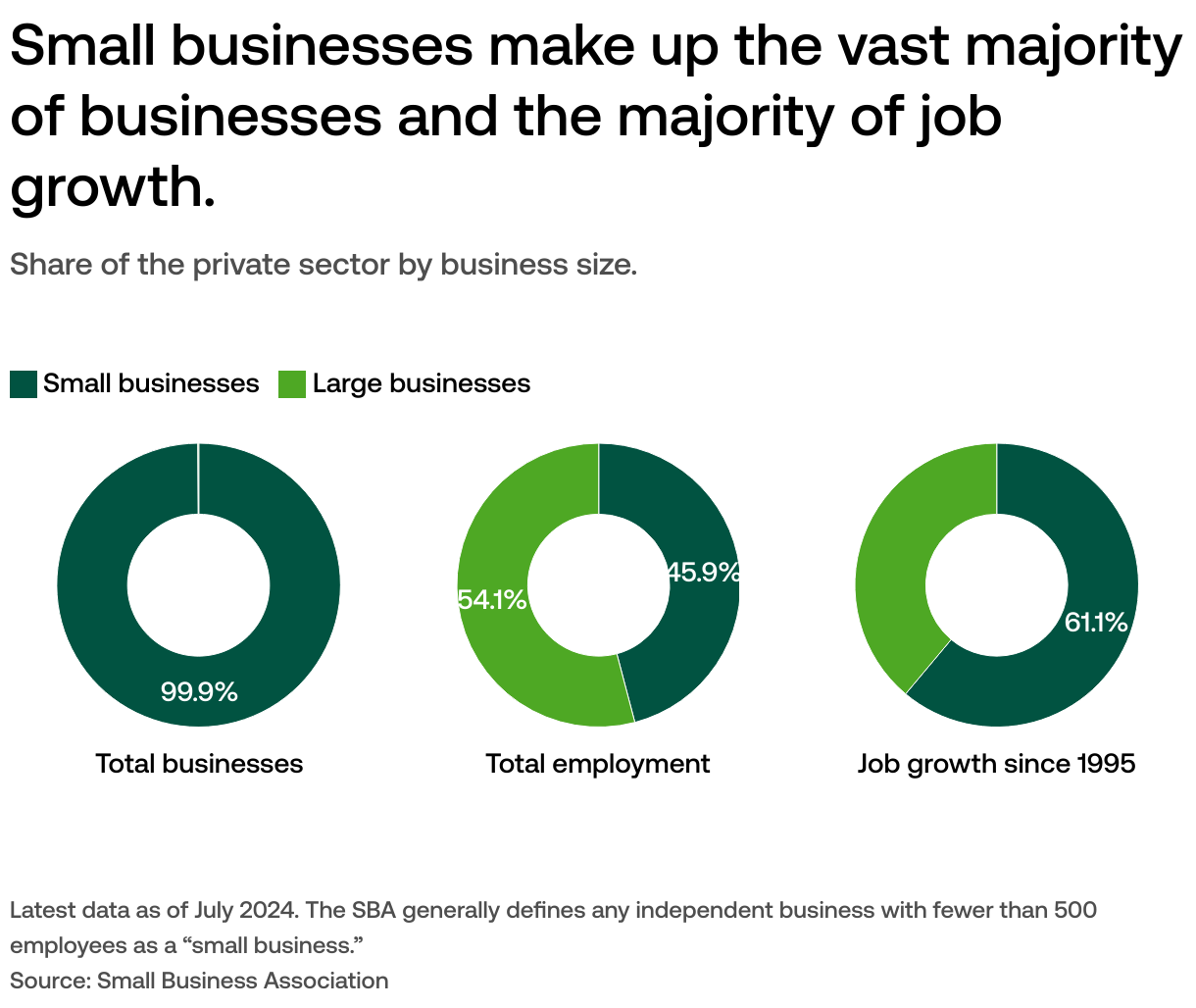

For investors willing to build new infrastructure, the crisis is a massive opportunity. Small businesses account for 40% of the U.S. GDP, employ over 60 million Americans, and have created two of every three jobs over the past 25 years. According to Gallup, Americans have consistently ranked small businesses as their most trusted institution —a striking contrast at a time when confidence in nearly every other institution is at record lows.

Many show consistent earnings through economic cycles, strong customer relationships, and long-standing vendor partnerships. Traditional private-market investors have ignored them due to their size, creating a valuation gap that leaves these businesses trading at multiples two to three times lower than larger companies in the same industries.

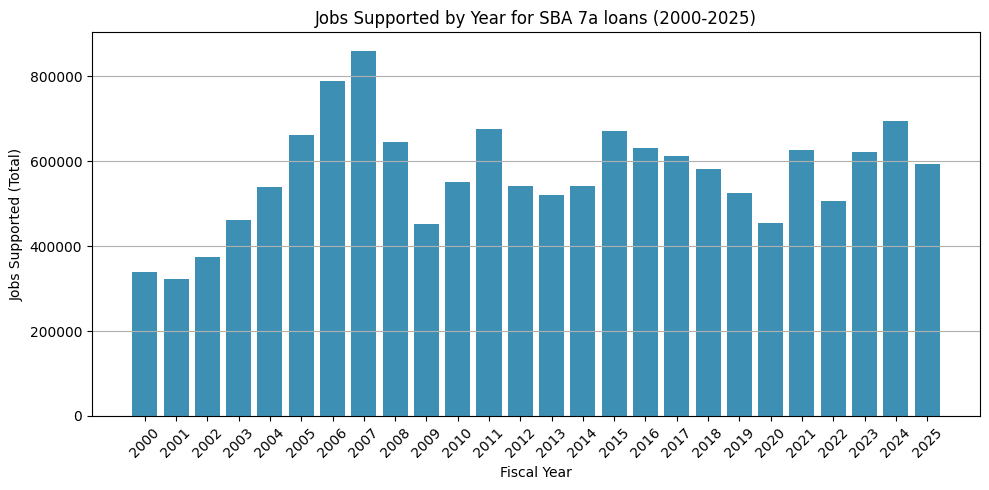

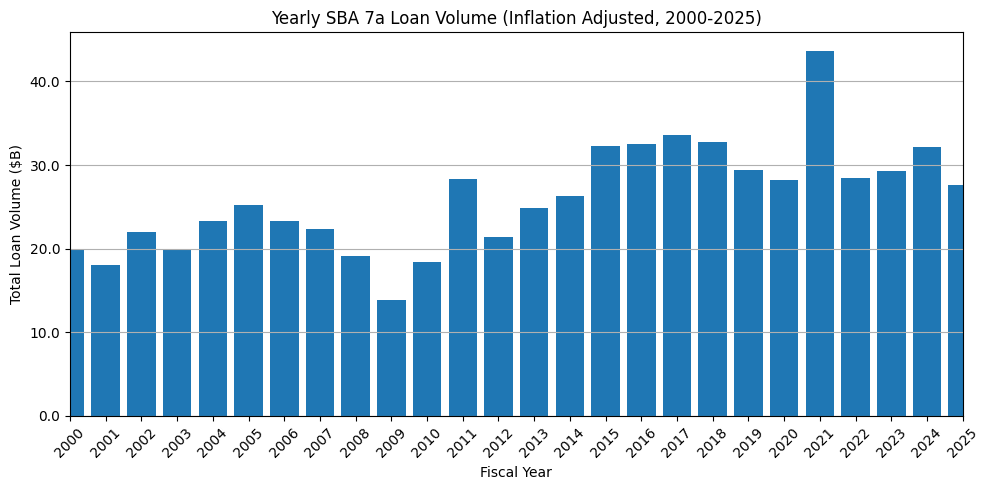

Government programs make them more attractive to buy. SBA loans offer favorable terms and low down payments. The model has proven resilient, with the average default rate for SBA 7(a) business acquisition loans being just 1.8% between 2019 and 2024. Since President Trump took office, the SBA has approved over $32 billion worth of 7(a) and 504 loans to support America’s small businesses. With low purchase prices and increased access to financing, simply maintaining steady operations can generate strong returns.

Artificial intelligence offers additional upside. New tools can cut administrative time, improve marketing, and optimize operations—making existing businesses more productive and profitable. For skilled operators with proper support, even small improvements can generate exceptional returns when combined with low purchase prices.

At 8VC, we have been interested in this space for some time and were excited to invest in Mainshares to help unlock a new model for small business ownership. Mainshares connects skilled operators with businesses for sale, creating opportunities for aspiring owners and ensuring local enterprises can thrive. Their support of local communities is so popular that small businesses across America proudly display their stickers.

I’m also excited to partner with my colleague, Denis Aven, on a new strategy specifically built for small business investing. He will remain a close ally of 8VC, but is spinning out of our core business to create and implement this new strategy.

His goal is to overcome the structural barriers that have kept institutional capital on the sidelines in three key ways:

1. Access to Talent:

Experience nurturing talent ecosystems will serve as a pipeline for attracting top operators who want to transition into entrepreneurship through acquisition. Through his time at 8VC, Denis will also be a valuable partner to Mainshares in building this network.

2. Tech-First Operation:

At 8VC, we’ve built durable, technology-driven companies, which gives us a deep understanding of what’s possible and the landscape of new technologies being developed. Lessons from Palantir and other high-growth AI companies will inform how AI can boost productivity by integrating with people who are not necessarily experts in the technology. By using such tools to augment human capability, streamline workflows, and eliminate inefficiencies in due diligence, operations, and financing, Denis and his team will support our operators and enable institutional capital to efficiently access and manage smaller transactions at scale.

3. Aligned Partnership:

The guiding philosophy is simple: when our operators win, we win. Denis and his team operate under a non-control structure that empowers Americans to become true, independent owners, aligning incentives for long-term value creation. This model helps driven individuals—those willing to work hard but who may not yet have the necessary capital—build wealth and success over time. It’s a major advantage to support SMB operators with best-in-class tools, data infrastructure, and access to a world-class technology network, including top AI-enabled companies across a number of sectors.

This is an important mission for America, and if successful, everyone will benefit. Most importantly, Denis’s work, like that of Mainshares’, can help save tens of thousands of jobs while giving new builders a reaffirmed hope in America as a land of opportunity for those willing to put in the effort. In doing so, they will uplift their families and communities, building a new generation of entrepreneurs who might never have had the chance otherwise.

The Silver Tsunami is approaching rapidly. Millions of small businesses will need new owners, and capable operators need capital and support to step up. All of us should help invest in and support the engine of Main Street’s prosperity to keep it running for generations to come.

Joe Lonsdale

Denis Aven (denis@kodiakholdings.com)

Disclaimers: The views expressed are solely those of the authors. This article is for educational purposes only. It does not constitute investment advice or a solicitation to provide advice, and is not an offer to sell or a solicitation of an offer to buy any securities. All investment strategies, including the strategies discussed in the article, involve the risk of loss of any money invested. Any investor should consult its professional advisors before making any investment. The data is used for illustrative purposes only, is in summary form, and may become out of date.

Once again, Joe has hit the mark. Stimulating the economy, one small business at a time by equipping and empowering those that have skills but lack resources. Thank you for your thought leadership, Joe.

So very true. Shamelessly self-promoting a wonderful company I invested in: Baton (https://www.batonmarket.com/)

In their words, Baton gives every small business owner—and future owner—the insight they need to plan their next big move. We’re working to make small business ownership attainable for everyone. And that starts with universal access to reliable data and trusted expertise.